In the first year after a two-year interruption in normal activity caused by the COVID-19 pandemic, the Naples real estate market is stable in terms of value, but there are not as many homes to choose from, and prices have elevated. As pandemic restrictions loosened in 2022, sellers and buyers pivoted their attention from the housing market to the travel market. As a result, and according to the December 2022 and 2022 Annual Market Report by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County (excluding Marco Island), overall closed sales in 2022 decreased 34.8 percent to 10,156 properties from 15,570 properties in 2021. And while inventory is beginning to rebound,

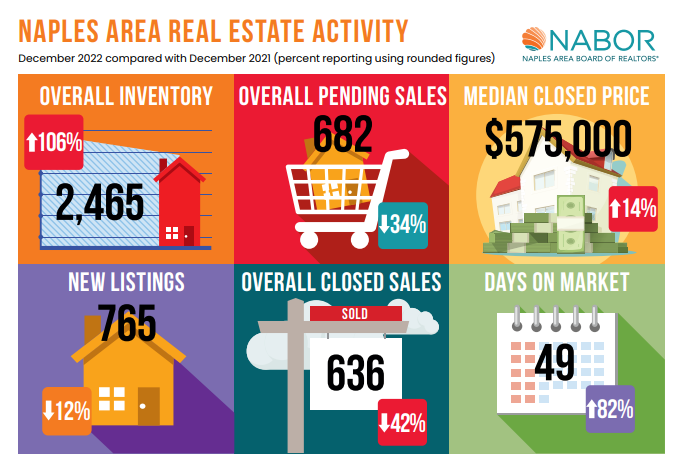

increasing 106.3 percent to 2,465 properties in December 2022 from 1,195 properties in December 2021, broker analysts reviewing the report are uncertain where and when an influx of inventory will arrive to meet our prepandemic levels.

The report showed only 105 homes for sale below $300,000 in December compared to 1,816 in December 2019. Reviewing the report, Mike Hughes, Vice President and General Manager for Downing-Frye Realty, Inc., remarked that “aside from the below $300,000 price category, inventory nearly doubled in every other price category by the end of 2022 compared to 2021.”

Demand for the Naples lifestyle remained constant in 2022, and low inventory pressed median closed prices upward. The overall median closed price in December 2022 increased 13.9 percent to $575,000 from $505,000 in December 2021. Looking back at December 2019, the median closed price was $344,255; and inventory was double what it is today.

“We can expect values to stabilize despite our tight market,” said Cindy Carroll, SRA, of Carroll & Carroll Appraisers & Consultants, LLC. Carroll believes the challenge moving forward will be convincing sellers and buyers that factors in place during the pandemic, when prices soared due to elevated demand, are completely different than they are today. “It’s going to take a while for us to readjust to our new market conditions.”

Economic factors affecting our market include a possible recession, and rising mortgage rates, which are still over six percent, on average. “Many people who bought a home in the past ten years enjoyed a very low fixed rate,” said Jillian Young, President, Premiere Plus Realty. Carroll added that, “when you factor in rising rates, insurance, assessments, and taxes, the cost of buying a home today in Naples is a lifestyle that many people can’t afford.”

These same factors are affecting new listing inventory as well. Demand for homes in 2022 kept REALTORS® busy looking for new listings, which dropped 8.4 percent to 13,577 compared to 14,819 in 2021. Many homeowners, especially those who purchased homes below $300,000 or at low interest rates, are now unable to afford a change in local address due to the increase in mortgage rates.

Then, in the wake of Hurricane Ian, the Naples real estate market pivoted again in the fourth quarter of 2022. Homes that suffered damage fell into two categories depending on their age and the Federal Emergency Management Agency (FEMA) 50 percent rule. (The FEMA 50 percent rule, as part of the National Flood Insurance Program, mandates that if a home incurs substantial damage — determined when repair costs total or exceed 50 percent of the property’s market value — it must be brought up to current building codes and floodplain regulations.) “Older homes in affected areas like the Moorings, Park Shore and Naples Park are facing this situation now, which might produce some new inventory, as the owners may not want to bear the cost of renovation,” said Adam Vellano, a Naples Sales Manager at Compass Florida.