Naples housing market experts reviewing the July 2022 Market Report by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County

Naples housing market experts reviewing the July 2022 Market Report by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County

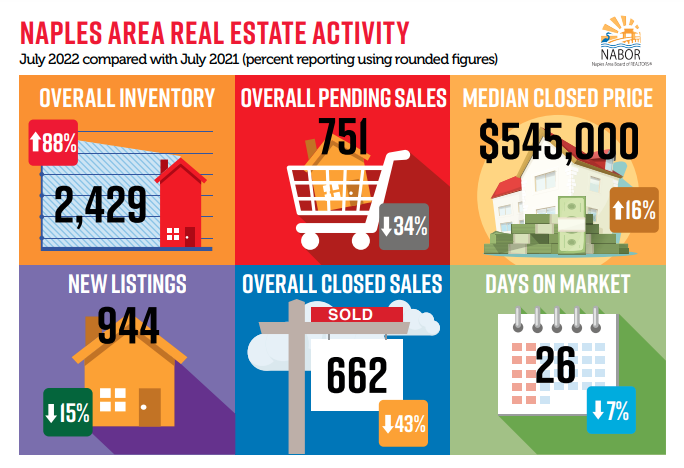

(excluding Marco Island), confirm the data reflected familiar activity levels akin to prepandemic summer months. Historically, closed sales in Naples during summer months trend around 800 sales a month. But during the last two years, summer sales were well above 1,000 closed sales a month. This July, overall closed sales decreased 43.4 percent to 662 closed sales from 1,170 closed sales in July 2021. For perspective, in July 2018 and 2019, there were 774 and 829 closed sales, respectively. The current level of activity is what market experts expected in a postpandemic summer and consider it a sign that we are on a path back to a balanced market.

Additional indications in the July report that support this shift is the number of pending sales. As such, overall pending sales decreased 33.8 percent to 751 pending sales from 1,135 pending sales in July 2021. The tempering of closed and pending sales, which began in June, is producing one very welcome result: an increase in inventory. In July, inventory rose 87.6 percent to 2,429 properties from 1,295 properties in July 2021 (there were 5,200 properties in inventory during July 2019).

“In a balanced housing market, buyers have more opportunities,” said Brenda Fioretti, Broker Associate at Berkshire Hathaway HomeServices Florida Realty. “They might look at five or six homes, maybe take a break for a couple of days, then go look at five or six more. That’s possible in a balanced market because homes aren’t flying off the shelf.”

Starting in the fall of 2020 and continuing into this past spring, the Naples housing market experienced remarkable sales activity that was fueled by a frenzy of home buying by those seeking the ideal Naples lifestyle. However, as pandemic pandemonium diminished, broker analysts predicted a slow, gradual return to a balanced market would occur in Naples.

Dominic Pallini, Broker at Vanderbilt Realty, remarked that, “We have a very resilient market. When sales went off the charts during the pandemic, our inventory plummeted, and this contributed to price increases. In July, there were 905 price reductions compared to 293 price reductions in July 2021. But demand is still very high. The difference is that today, buyers don’t feel the pressure to buy like they did during the pandemic. They are taking their time to find a home that they feel justifies the price.”

Adding his opinion that our market has shifted and is now on a trajectory to become balanced again, Budge Huskey, CEO, Premier Sotheby’s International Realty, said, “The report showed pending sales were off less than closed sales in July, which indicates we have likely reached the bottom and can expect to now turn the other way.”

Market experts reviewing the July report say buyers should not expect home values to drop dramatically. While year over year price growth is trimming, demand is still high, and inventory is still not at prepandemic 2019 levels. The median closed price in July increased 16 percent to $545,000 from $469,950 in July 2021; it decreased 9.8 percent from $604,000 in June.